The news today is pretty scary. We’re in the throes of one of the most divisive election cycles in the history of our country. Terrorist attacks are happening with alarming frequency, relations between Russia and the U.S. are at a historic low point, the Middle East is a tinderbox, Britain has voted to leave the EU and the EU countries are struggling with a serious refugee crisis.

As an investor, it’s a critical time to reevaluate your positions and consider ways to protect your assets. Paper money is losing value as governments around the world are trying to re-inflate stagnant economies through the power of the printing press. As a result, many analysts feel that stocks and bonds are at artificially high and unsustainable levels.

Diversification is a proven strategy for protecting your wealth by spreading the risk over different asset classes including stocks, bonds, real estate, commodities, cash, and precious metals.

The Benefits of Precious Metals Like Silver

Physical precious metals like silver are a hedge against inflation, currency markets, and political and social unrest. The case to buy silver now is based on not only the state of world affairs but also the fundamentals of the silver market. As an investment right now it’s very affordable, and silver is a portable and liquid investment. Silver is a smart precious metal choice due to its dual use as both a store of value and its strong market as an industrial metal used in electronics, medical devices, manufacturing, and pharmaceuticals.

In fact, silver has hundreds of industrial and medical uses and demand is steadily growing. Because of silver’s molecular and chemical properties, it is unique among the earth’s elements and is indispensable in the industry as the most reflective, electronically conductive, and thermally conductive metal. Modern life as we know it could not exist without silver.

The Fundamental Case To Buy Silver

The case to buy silver today is very strong based on the market fundamentals of supply and demand. Currently, the price of silver is below the cost of extraction. Whenever any commodity is priced below production cost, it is undervalued and a strong buy. In just the past twenty years silver use has exploded. Seventy-percent of inventory is used annually in industrial and medical applications and use is continuing to grow. Once it is used, it is effectively removed from stockpiles never to return. As the information age continues and new products come to market, silver use will only go up in the coming years.

The above-ground inventory of silver has been shrinking steadily as a result of demand in industrial and medical applications. This is unique among the precious metals group. With demand exploding, production has not been able to keep up. Demand in 2012 was around 880 million ounces with annual mine production at 760 million ounces. Scrap silver has been making up the deficit but as demand continues to skyrocket, production will not meet demand.

Today, the majority of inventory is produced in countries with unstable political systems, underdeveloped infrastructure and labor problems. The top two producers are Mexico and Peru, both with fragile political systems and underdeveloped infrastructure unable to support increased production. The number six producer is Bolivia which recently nationalized the mines and that may put a strain on supply.

As monetary policy continues to flounder as a result of the banking crisis, governments around the world have been printing money in order to re-inflate the economy. Throughout history, periods of excessive government intervention by printing money have been followed by periods of inflation. Currently, the Venezuelan economy is in a state of hyperinflation due to misguided monetary and political policy. Is this an anomaly, or merely the first domino to fall? In times of economic and social uncertainty, precious metals tend to outperform other assets and are a store of value. Silver is currently undervalued and worth a look.

How To Invest in Silver

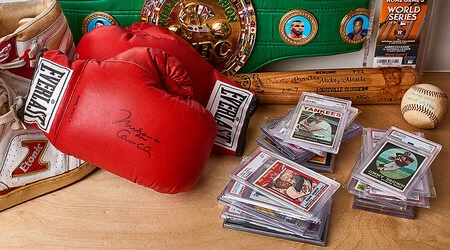

Silver is available in a variety of forms for investment including rounds or coins, bars, and bags also known as junk silver. The first step is to find a reputable dealer. Silver is priced daily on the spot metals market. A reputable dealer will sell you silver at the daily spot price plus a small markup or premium. When it’s time to sell, the same dealer will offer to buy at the daily spot price plus a small seller’s fee.

Your dealer can help you to set up a systematized plan to build a position over time using dollar-cost averaging. They can also help you choose the form of silver that best meets your needs, whether it’s one-ounce coins, five-ounce bars, or $500 dollar face value bags of 90% silver pre-1964 US coins. You can arrange to have your silver delivered directly to your home. It’s important to take physical possession of your metal as in the event of a crisis you may not be able to access your bank or other source holding your investment.

Silver can also be held in a precious metals IRA and a knowledgeable, reputable dealer can advise you on the proper way to set one up if you choose.

Precious metals are a great way to diversify your holdings and protect your assets in an increasingly volatile and unstable world. Silver is undervalued, portable, affordable, and liquid. With heavy industrial demand and shrinking supply, silver is poised to increase in value in the coming years. Find a reputable dealer and begin a systematized investment strategy to build a position while prices are still low.

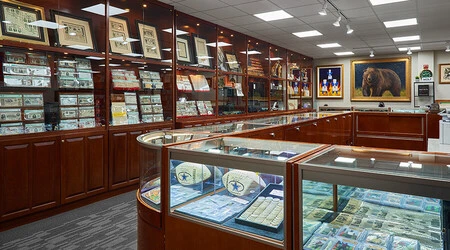

IF YOU ARE INTERESTED IN BUYING OR SELLING SILVER, CONTACT U.S. COINS AND JEWELRY, HOUSTON'S MOST TRUSTED SOURCE, AT 8435 KATY FREEWAY IN HOUSTON OR CALL 713-597-6367.

SOURCES:

https://en.wikipedia.org/wiki/Silver_as_an_investment

http://www.silverinstitute.org/site/silver-in-industry/

https://goldsilver.com/blog/top-10-reasons-to-buy-silver/

https://www.caseyresearch.com/articles/top-7-reasons-im-buying-silver-now

http://stansberryresearch.com/investor-education/buying-silver-today/